Managing a business involves a variety of risks, including natural calamities- something that’s completely out of your control. These risks have an enormous potential to make your business face downfall or distress. Even the tiniest risk has the capability to put your entire business process at stake.

And, what’s more? They can be expensive and time-consuming to fix. Regardless of company size, CEOs, VPs, or risk management officers should foresee the risks and have a plan to curtail these risks and address them before they hamper their business.

In this blog, we’ll define risk management, go through all the key points, and explain how our quality risk management software can help you manage risks. With all this info, you’ll be able to plan your risk management strategy and needs better.

Contents:

- Overview

- What is risk management?

- Risk management principles

- Risk management process

- Why is risk management crucial for your company?

- QualityPro: Tackles your risk to let you focus on your business processes

- Summing Up

Overview

Ideally, I would say it is impossible to eliminate all the risks but, it is possible to think about all the potential risk factors that your business could experience and stay prepared to handle them. And this is doable with automated risk management software. An effective risk management software focuses on the connection between risks and their significant harmful impacts that can stop organizations from fulfilling their strategic goals.

Let us first know what risk management is and what its causes are –

What is risk management?

The process of identifying, assessing, and controlling threats to an organization’s assets and earnings is known as risk management.

Risks originate from a range of sources and can be both internal and external. Internal risks can be caused due to your employees, vendors, leadership decisions, etc. whereas external risks can be caused by a number of things such as financial uncertainty, legal responsibilities, technological problems, strategic management blunders, accidents, and natural calamities.

Talking about the situation that occurred say two years before,

When COVID-19 entered the market, businesses faced a significant threat to their operations. Prior to the pandemic, nobody ever imagined or was prepared to deal with the level of impact it had on practically everything, including businesses. Numerous businesses collapsed, many people lost their jobs, and factories were shut down, all of which resulted in huge losses. Now that the COVID-19 effects are stabilized, CEOs and Directors of various companies are taking a fresh start to look at their risk management programs. They are reconsidering their risk exposure and examining risk-mechanism processes.

Companies are considering the competitive advantages of a proactive strategy and substituting it for their existing strategies, reducing the use of traditional techniques like guarding against past risks, changing risk management only after a risk has caused harm, etc. Business interest in achieving sustainability, resilience, and corporate agility has increased because of this.

Before moving further, it is now important to look at the principle of risk management.

Risk management principles

The International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH) states that there are two main principles of quality risk management:

- A better risk evaluation should be based on facts and research from scientific knowledge and should ultimately aim to protect customers.

A quality management procedure should be proportional to risk level- higher the level of risk, stronger the plan. The time required, and formal documentation requirements should all be in line with the degree of risk.

Risk management process

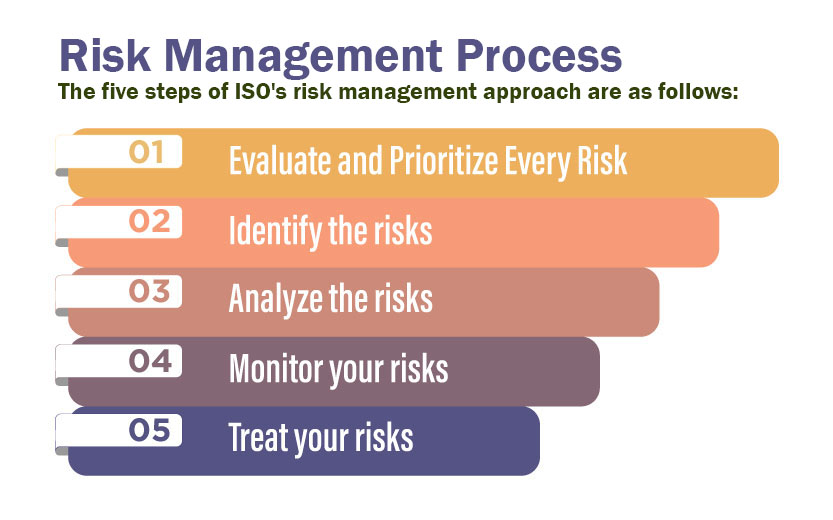

The five steps of ISO’s risk management approach are as follows:

Step: 1 Identify the risks:

List out all the risks that your company might experience while operating. Generally, this process is performed routinely. Start a risk assessment by looking at the elements in your business and surroundings that could be risky, such as regulatory, legal, environmental, market, and other hazards.

You should be aware of potential threats to your company, such as technical hazards, single point of failure (SPOF) dangers, and natural calamities.

Step: 2 Analyze the risks

After identifying the risks, conduct a risk analysis. Some risks can bring your business to a standstill, while some will only be minor inconveniences. To analyze each threat and determine its potential disruption, ask: “How probable are these risks to occur?” And, if it occurs, then what are the consequences?

You can then establish a link between the risks and varied factors within your organization. This will help you comprehend how many business operations the risk influences. The risk increases as the number of functions increases.

Step 3: Evaluate and prioritize every risk

Rank and order each risk according to its intensity. This helps the risk management team to view and understand the complete risk exposure of your firm. For instance, threats that might only cause little inconvenience should be given less importance than those that could result in catastrophic losses.

Determine your risk appetite and tolerance by creating a risk profile. Some businesses feel confident taking a lot of chances, while others desire to take no risks at all.

Step: 4 Treat your risks

Create a risk management system to mitigate each risk. You and your team should start by addressing the risk with the highest priority in order to prevent it from jeopardizing your organization. Contacting the appropriate experts in each field where the risk exists is a clever way to begin.

Step: 5 Monitor your risks

Determine whether your risk mitigation activities are sufficient or whether you need to make any changes by routinely monitoring, tracking, and reviewing your performance. If the risk management approach put in place is not workable, your team will have to start again with a fresh procedure.

To solve issues, avoid acting on impulse and getting into “firefighting mode”. Instead, a cool, clear perspective will help you limit the damage caused by project hazards and seize opportunities.

Why is risk management crucial for your company?

If you are still not convinced, consider the repercussions of delaying the implementation of a competent risk control strategy until you know how things play out for your company’s bottom line. The picture below mentioned in your business that might make you think again about establishing a risk management system, if still not convinced-

- Deficiency or Limited Growth

A risk management system can help and facilitate the expansion of your business. There is still a probability that some threats may develop despite your best efforts, no doubt. However, after identifying, evaluating, and controlling risk, your odds of success will increase, enabling more confident decision-making.

- Lawsuits

Companies that break laws and regulations have the risk of being sued by the government, employees, customers, rival companies, or other parties. If you find yourself in one of these circumstances, your company may have to spend a lot of money on legal bills, settlement costs, or even both. However, adopting a risk management system can limit or even dilute chances of such situations.

- Large Losses

Additionally, inefficient risk management has a big monetary impact. You stand to lose a lot if you do not have one. This could even include lower market share just because you weren’t able to anticipate changes in the market environment. You risk pecuniary loss if you don’t plan for the risks of growing your company. If you’re not prepared to manage issues, your company’s reputation could also be permanently harmed.

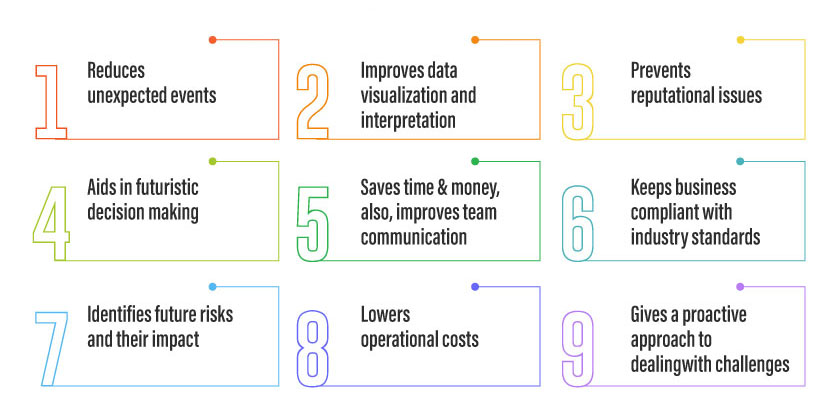

Discover the many advantages of integrating Risk Management Software into your company:

Speaking directly, if not adopting a quality risk management system brings about above-mentioned challenges, implementing one-

QualityPro: Tackles your risk to let you focus on your business processes

QualityPro gives you a thorough understanding of your business’s risk landscape. This covers all product lines, company divisions, processes, quality control, document management, and much more. You can easily identify and mitigate long-term system, process, and product risks with the help of this risk management software’s tracking and proactive management. It is an innovative tool that helps in mitigating and avoiding risks as well as stealth process flaws that are in line with their impact and likelihood of occurring.

This Risk Management System creates a secure and simple-to-understand platform with modern capabilities, allowing you to keep a rigorous eye on risk updates.

The list of features that follows clearly illustrates why QualityPro Risk Management System is the top choice in the industry:

Summing Up:

The pandemic is a great example of a risk issue that emphasizes on taking a holistic, long-term strategic view and action on the various kinds of risks that could hurt you as a company. It’s time for businesses to think about controlling threats and utilizing them to their advantage in order to minimize any bad effects on the company.

QualityPro enables you to evaluate risks and identify the broad effects of each risk more quickly by providing risk heat maps, dashboards, and reports. Schedule a demo to see how easy it is to know what risks to mitigate, how to mitigate them, track workflows, collect and store documents, and much more!